View Hardship Letter For 401K Withdrawal Example PNG. You also pay a 10 percent tax penalty for taking the. Hardship letter 401k withdrawal examples.

The internal revenue service allows early withdrawals from 401(k) accounts if, immediate and heavy financial need criteria are met.

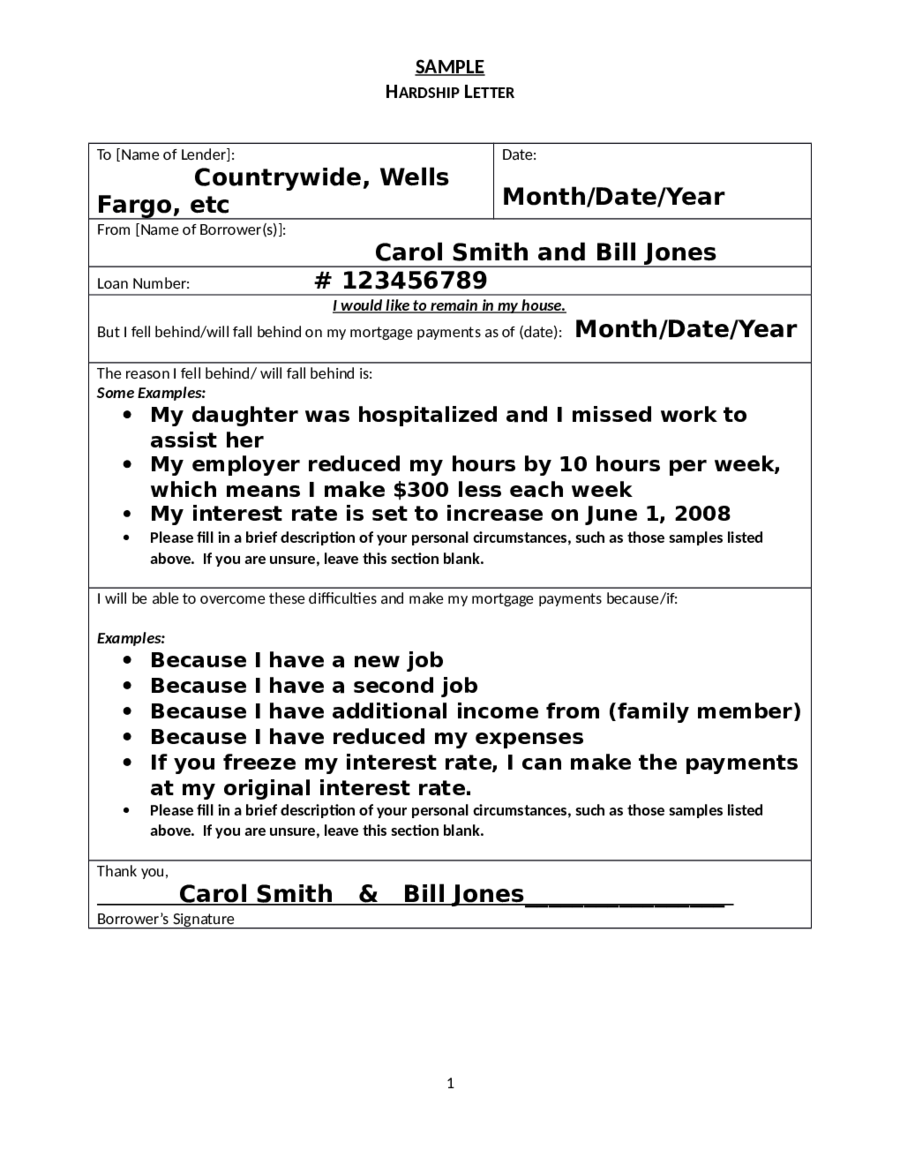

Companies often prohibit contributions for at least six months after taking. Pros and cons of hardship withdrawal include early contributions to the 401(k) are prohibited for six months following the hardship withdrawal: Employee's name employee's address city, state, zip code. This article explains how to submit hardship withdrawals for college.