50+ Example Of Hardship Letter To Irs Pictures. I have attached my most recent pay stubs {along with other relevant information} to illustrate. If you are unable to make your tax payment to the irs, you should consider writing a letter of hardship requesting some form of relief (delayed or reduced payment).

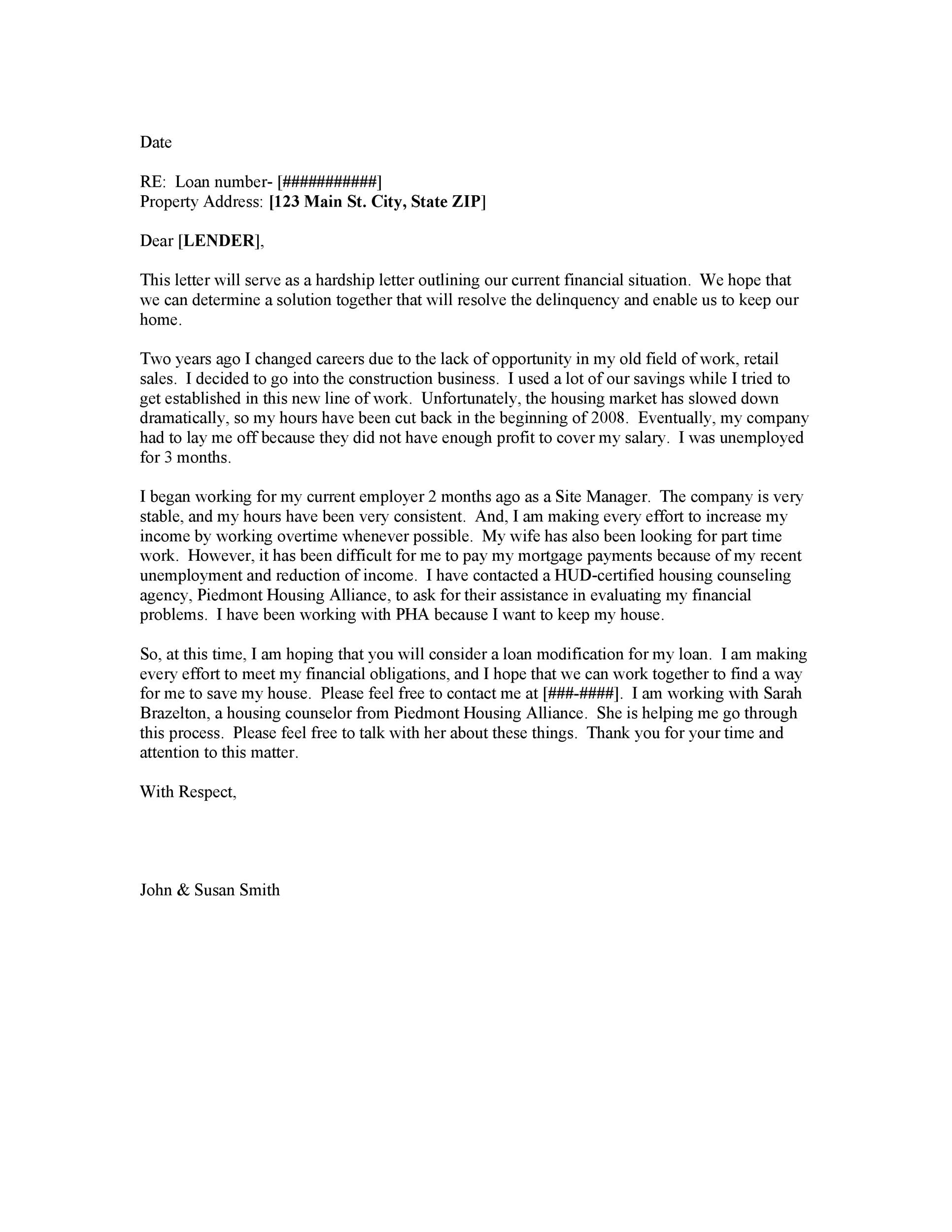

This letter is a key document in the effort to avoid.

What is the irs definition of hardship for a 401(k) plan? Get financial hardship letter for loan modification or mortgage. Hardship letters can be a crucial part of your debt resolution. A hardship letter is a letter written to request leniency or special consideration in the case of financial difficulties.